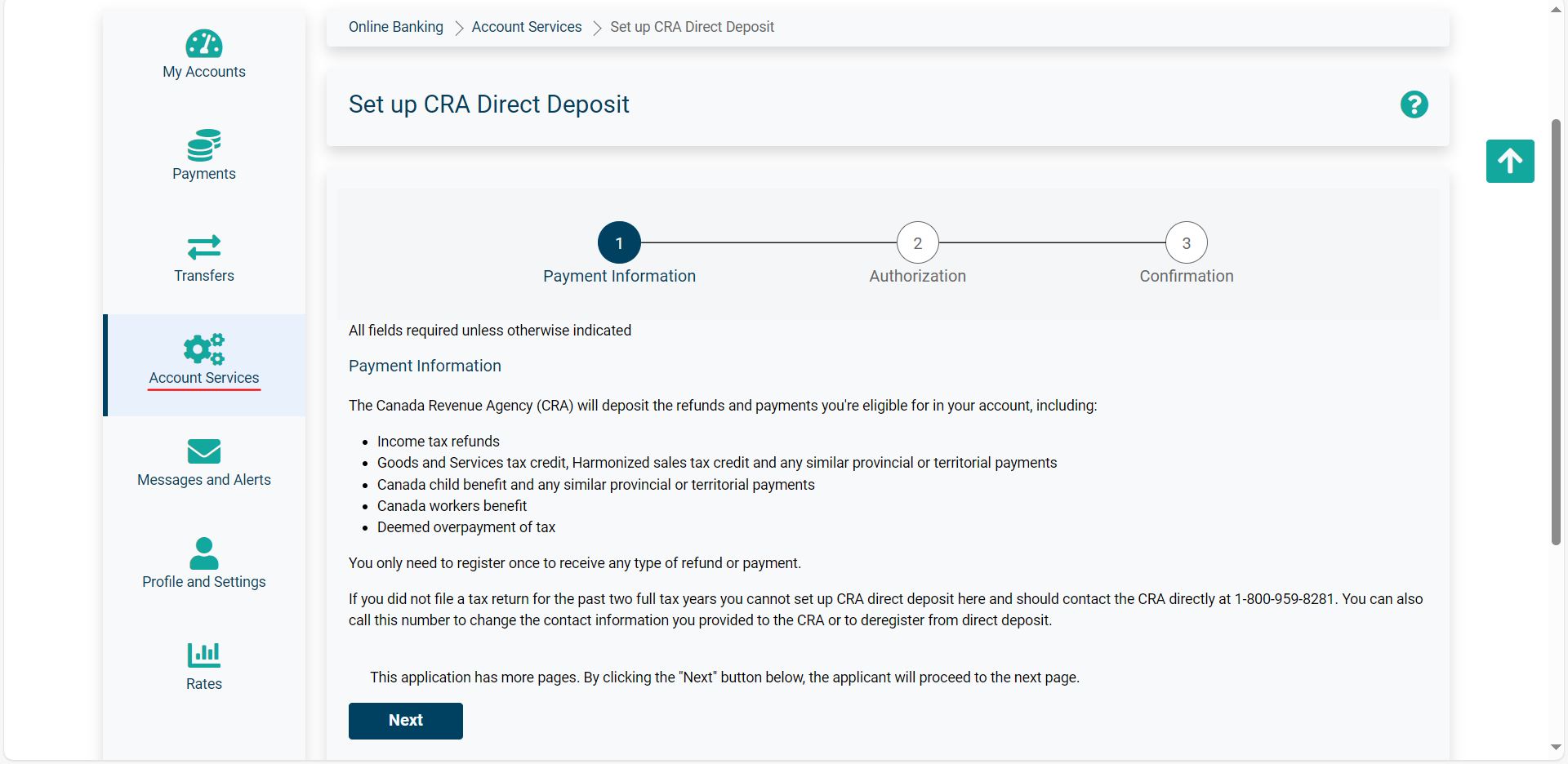

Canada Revenue Agency (CRA) Direct Deposit with online banking - Set Up Guide

It's easy to sign up for direct deposit from the CRA through online banking.

Our members can quickly designate what account they want their Government of Canada payments to go to within a couple of minutes from the online banking platform with which they're already familiar.

Refund and Payment Information:

The Canada Revenue Agency (CRA) will deposit the refunds and payments you're eligible for in your account, including:

- Income tax refunds

- Goods and Services tax credit, Harmonized sales tax credit and any similar provincial or territorial payments

- Canada child benefit and any similar provincial or territorial payments

- Canada workers benefit

- Deemed overpayment of tax

You only need to register once to receive any type of refund or payment.

If you did not file a tax return for the past two full tax years you cannot set up CRA direct deposit here and should contact the CRA directly at 1-800-959-8281. You can also call this number to change the contact information you provided to the CRA or to deregister from direct deposit.

How to sign up?

The process is fast and simple.

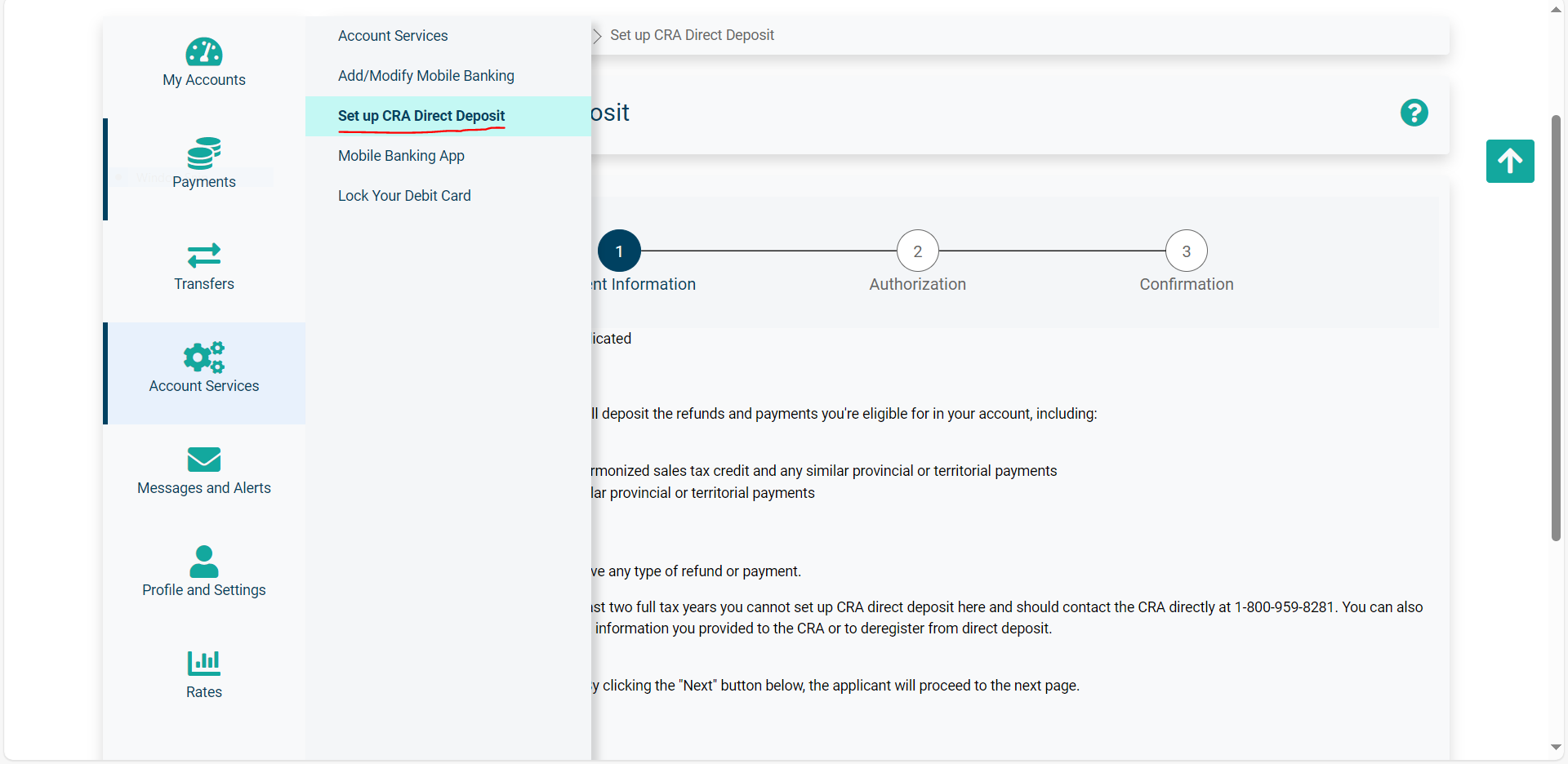

On the left-side navigation within our online banking platform, select Set up CRA Direct Deposit. This feature is only available for personal memberships.

Press Next to start the process.

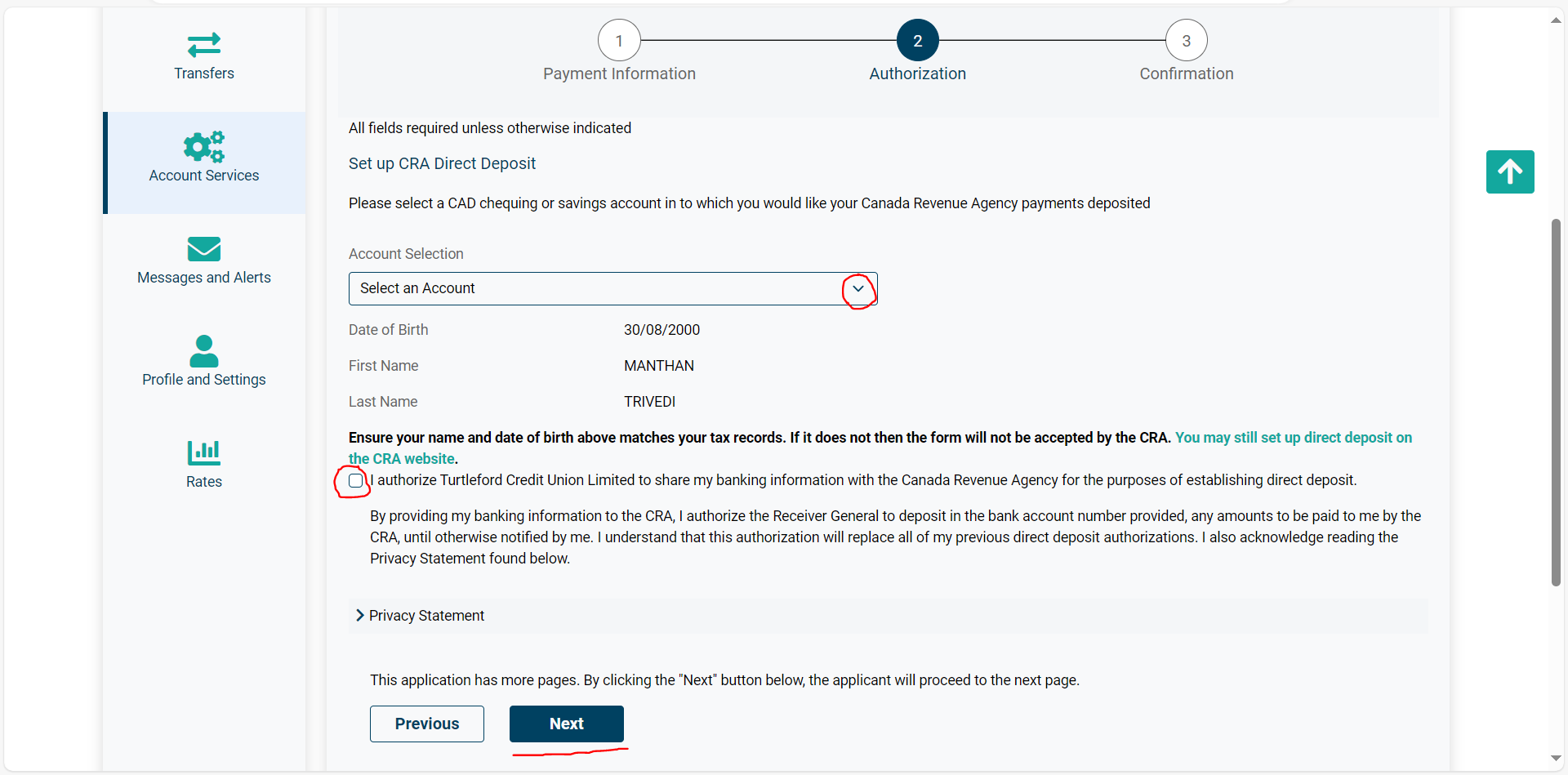

Please select a CAD chequing or savings account into which you would like your Canada Revenue Agency payments deposited.

Ensure your name and date of birth above matches your tax records. If it does not, then the form will not be accepted by the CRA. You may still set up direct deposit on the CRA website.

Acknowledge the consent and privacy statements by clicking on the checkbox and then click Accept.

Click on Next to proceed to the next page.

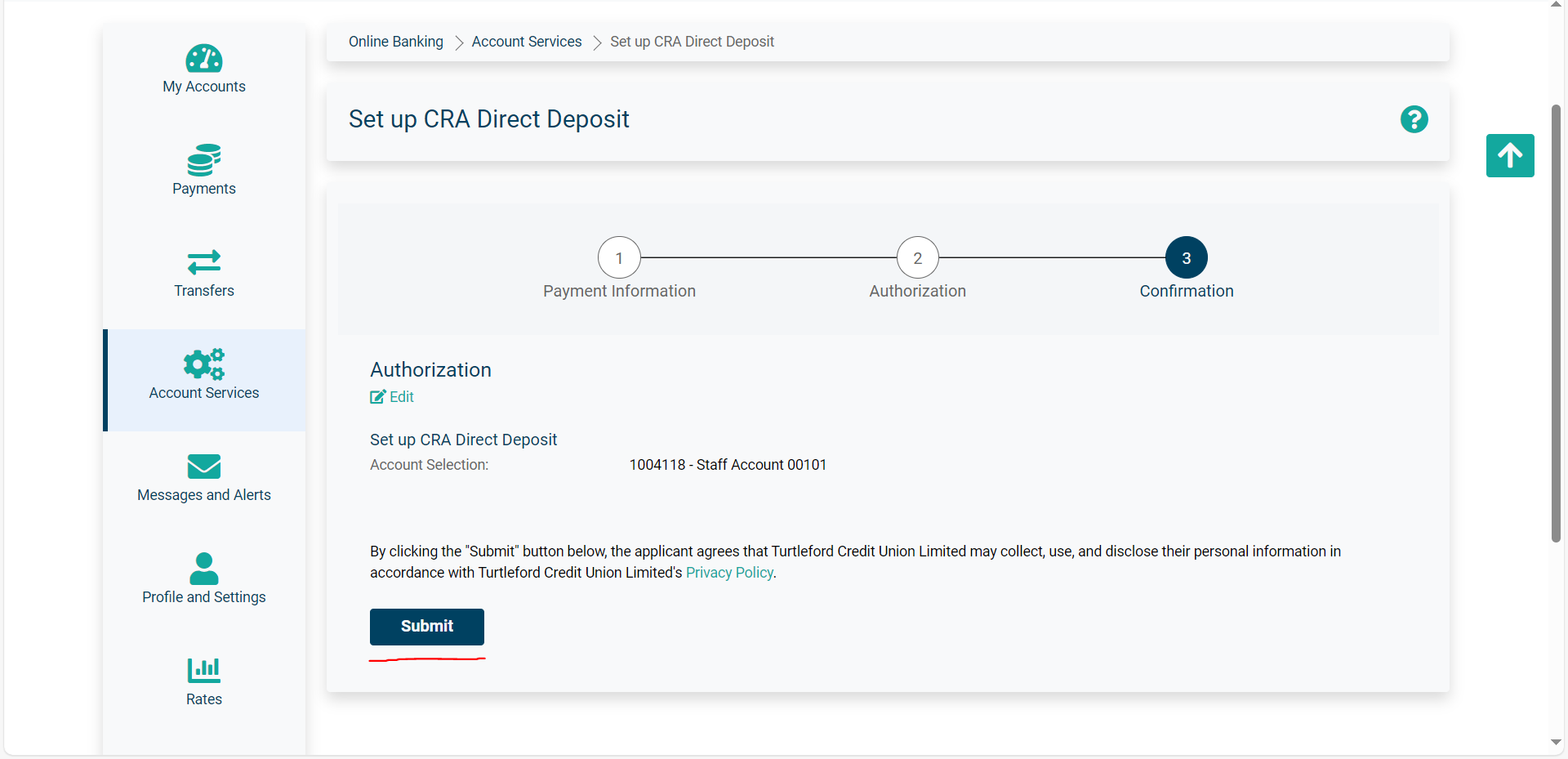

Verify your information and click Submit.

You’ll receive confirmation to indicate that the enrolment process is now complete. Your account number and account type will display on the confirmation screen. Should you wish to change your banking information with CRA in the future, you’ll need to contact them directly at 1.800.959.8281.